BARD MAY HAVE COST GOOGLE $160BLN IN

VALUATION WEIGHT LOSS SO FAR (NOT $100BLN), BUT IT’S NOT ALL DOOM & GLOOM

FOR GOOGLE

THE

BIG PICTURE

Ø Satya Nadella, Microsoft’s CEO, admitted this week that as

searches grow more complicated, they will get more expensive: “From now on, the

(gross margin) of search is going to drop forever!” (quoted by Yahoo Finance).

Yes, he was referring to the additional or incremental costs from processing or

computing power associated with integrating AI into search engines. And that

complication will cost more to all players (NOT just Google) in the long term.

The main challenge for Google, unlike Microsoft and other key players, is that

it has historically built its business model on very high margins and on

advertising (81% of its total revenues in 2021).

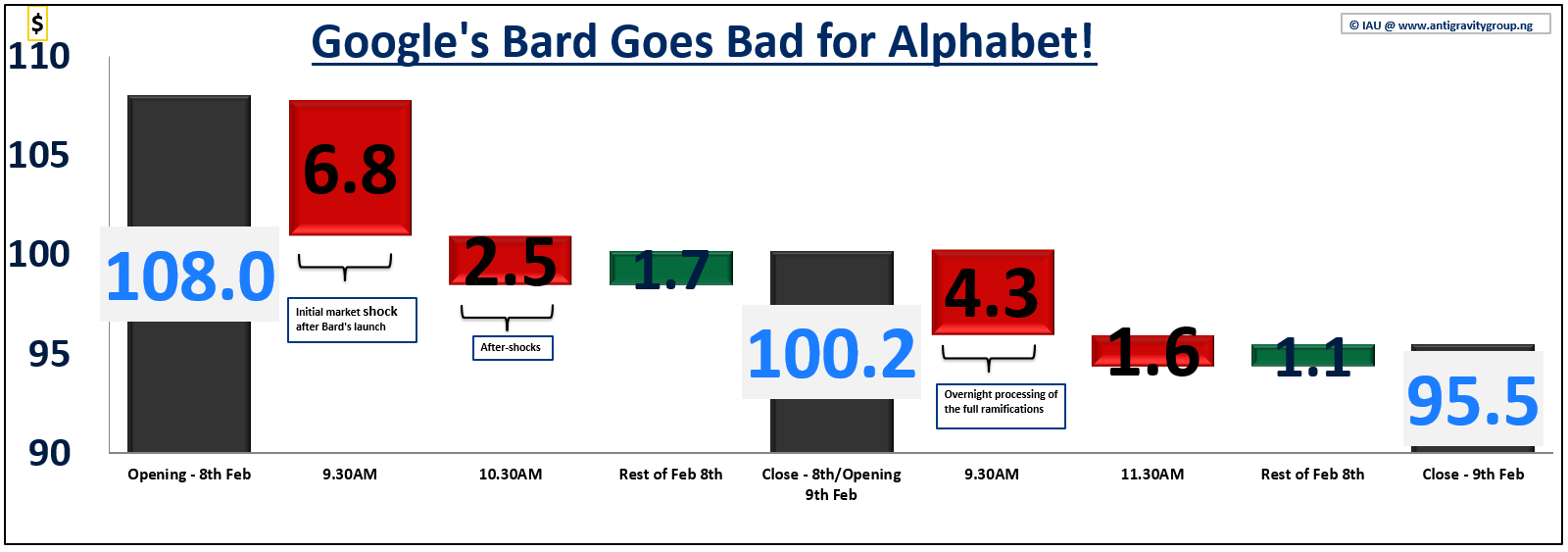

Ø The $160bln valuation evaporation from Alphabet in the past 2

days is beyond just a mere glitch with Bard that Reuters picked up after

Google’s launch of Bard in Paris on Feb 8th. No, it’s more about concerns that

are at the very heart of Google’s corporate existence.

Ø When it comes to shareholders and investors, 3 things are

very key to them: revenues, costs, and growth. They care about the levels,

directionality/trend, and sustainability of those 3 items as well.

Ø For revenues, it’s simple: more is better; and for costs,

less is better, of course. Growth affects the directionality of both revenues

and costs. So, shareholders or investors are happiest when revenues travel

north, and costs travel south (with some confidence that the trend will be the

same – or sustainable – over a long period of time).

Ø So, for Google’s or Alphabet’s shareholders, what happens

when a new emerging threat (like ChatGPT and AI-powered innovations in general)

unsettles them on all 3 key items they are always looking at? They will embark

on what finance folks call a “flight to safety” by offloading their shares as

we have witnessed in the past 2 days per the chart below.

Ø But let’s not get carried away by Microsoft’s recent wins,

its CEO’s rhetoric, or Alphabet’s (Google’s) shareholders’ panic. Google

isn’t going anywhere any time soon. It doesn’t even need to win this new AI

fight to still be King; it just must not be scoring "own goals" in

the long run as it did this week with Bard’s horrible launch in Paris.

REVENUES & POTENTIAL IMPACT

Ø

Google’s main revenue source is

advertising (it accounted for roughly 81% of its total revenues in 2021). It

has roughly 80% of the market share in the search engine space. Typically, the

more people search on Google, the more links they will click, and the higher

the advert revenues.

Ø

With AI serving the ready-made

cooked meals, the less the links to be clicked. That’s bad for Google.

Ø

For Microsoft, advertising has never

been a major component of its business model or revenue stream; its Bing only

has 9% of the search engine market (vs Google’s 80%). So, anything from this

space is simply a bonus or an icing on the cake.

Ø

Integration of ChatGPT with Edge and

Bing will bump up Microsoft’s revenues from Azure (its cloud services

platform).

COSTS

& POTENTIAL IMPACT

Ø

The cost aspect is a bit tricky, so,

I will tread with some caution here, given my accounting background.

Ø

It has been estimated that it

currently costs OpenAI (owners of ChatGPT) $0.02 or 2cents per search query on

ChatGPT (per processing power). That number is debatably high, but let’s just

stick with it for now.

Ø

Eric Cuka (writing for The Motley

Fool) in an article posted yesterday (9th Feb) on nasdaq.com referenced a video by FiredUpWealth which suggested

that Google, historically respected for being a category king here, may end up

having higher processing costs from integrating AI (say, Bard) in its searches.

I scratched my head at the outset, and then set out to validate that

hypothesis. As it turns out, that may not be true. But as an accountant, I

think I understood the point being made which I will get to soon. First, let’s

play with simple arithmetic:

o

It’s estimated that Google currently

processes approximately 8.5bln searches per day on average ( I am quoting prof.

Luis Ceze of the University of Washington here). That’s my assumption 1.

o

According to Morgan Stanley, it is

projected that Google’s operating expenses (or OPEX) may skyrocket

(incrementally) by over $6bln per annum as a result of this strategic shift to

AI integration from 2024 and beyond, if 50% of queries (say, 4.25bln searches

per day per assumption 1 above) have natural language/AI integration. The math

works out to $1.4bln for every 10% integration (or 0.9bln searches/day).

Imagine a 100% integration (for 8.5bln searches/day). That’s $12bln+ on

incremental OPEX. I am further assuming 8.5bln searches today will be the same

in 2024.

o

Daily incremental total cost for

Google for its 8.5bln searches = $12bln/365 days = $32.88mln per day.

o

Incremental cost per search for

Google = $32.88mln/8.5bln = $0.0039 (or 0.39 cents).

o

So, you see: Google’s projected

incremental cost per search (0.39 cents) is just 20% of that of Open AI (2

cents).

To be continued...

Leave a Reply

By clicking the button above, you thereby agree to our Terms and Conditions regarding privacy information.